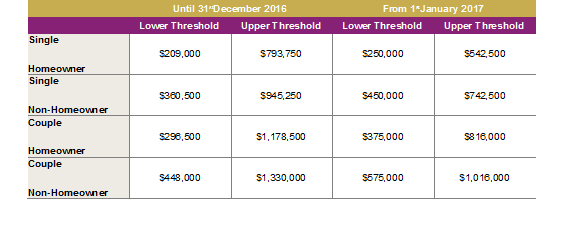

Changes to the Assets Test Thresholds for the Age Pension announced in the 2015 Federal Budget will come into effect from the 1st January 2017.

Changes to theses thresholds will mean Aged Pensioners with higher levels of assessable assets will have their pension entitlements either reduced or lost altogether. While those with lower levels of assessable assets may have their pension entitlements slightly increased as illustrated below:

What assets are subject to the assets test?

The following list of assets will remain subject to the Assets Test:

- Personal items and home contents:g. clothing, jewellery, electrical appliances;

- Financial Investments:g. cash, listed and unlisted shares, managed investment funds, superannuation benefits (if condition of release has been meet, i.e. you turned age 65), loans to family members;

- Family Business

- Vehicles:g. cars, motorbikes and caravans;

- Other properties:g. holiday/investment homes; and

- The surrender value of life insurance policies:g. whole of life and endowment policies.

The following assets will remain excluded from the Assets Test:

- Your principal residence; and

- The superannuationbenefits of a spouse under Age Pension age (currently 65) in Accumulation Phase, even if a condition of release has been met.

How the value of your assets can impact your age pension payments?

Your Age Pension entitlement is assessed against the Assets Test or the Income Test, whichever provides you with the lowest entitlement to the pension.

Currently, if you are assessed under the Asset Test your entitlement to the Age Pension is reduced by $1.50 (or 75c each for a couple) per fortnight for every $1,000 of assessable assets above the Lower Assets Test Threshold. From the 1st January 2017 your entitlement to the Age Pension will be reduced by $3.00 (or $1.50 each for a couple) per fortnight for every $1,000 of assessable assets above the Lower Assets Test Threshold.

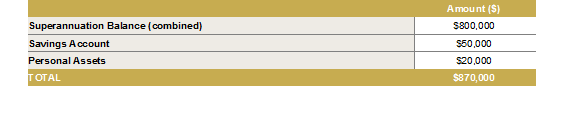

Example – Couple Homeowner:

John and Helen, both aged 70, are married and live together in a home they own. They have the following assessable assets:

Based on the current Assets Test (which gives John and Helen a lower entitlement than the Income Test) they are currently entitled to a part Age Pension of $12,015 per annum. However, from the 1st January 2017 they will no longer be entitled to the part Age Pension because the value of their assessable assets ($870,000) will be higher than the Upper Assets Test Threshold ($816,000).

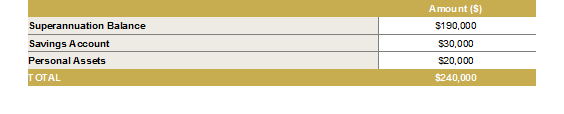

Example – Single Homeowner:

Jack, aged 75, is single and lives in an apartment he owns. He has the following assessable assets:

Based on the current Assets Test, Jack would be entitled to a part Age Pension of $21,595 per annum. From the 1st January 2017 his assessable assets ($240,000) will be below the Lower Assets Test Threshold of $250,000 and his pension will increase slightly to $21,731 per annum.

Will you lose your entitlement to the pensioner concession card?

As an Age Pensioner you are eligible to the Pensioner Concession Card which provides you with concessional rates for medicines under the Pharmaceutical Benefits Scheme, electricity, gas and water bills, public transport and motor vehicle registration. If you lose your entitlement to the Age Pension you will also lose your entitlement to the Pensioner Concession Card.

However, as part of the changes announced in the 2015 Federal Budget those who lose their entitlement to the Age Pension will automatically be issued with a Commonwealth Seniors Health Card (CSHC).

The CSHC also provides concessional rates on the cost of medicines under the Pharmaceutical Benefits Scheme and some concessions on public transport and other government and private sector services at their discretion but no concessional rates on electricity, gas and water bills and car registration.

The Government has indicated the usual Income Test will not apply to those who lost the entitlement to the Age Pension as a result of the new Asset Thresholds. This means that those people who lose their Age Pension and receive a CSHC will not have to meet an Income Test to retain this card going forward.

What can you do to remain below the upper asset test threshold?

There are a number of strategies you can pursue to maintain your entitlement to the Age Pension. These strategies include:

- Making additional contributions into your spouse’s superannuation fund ifthe spouse has not reached Age Pension age (i.e. 65) or is currently receiving a pension from that fund;

- Gifting up to $10,000 peryear or up to a maximum of $30,000 over a five-year rolling period;

- Undergoing home renovations on your principal residence;

- Bringing holiday plans forward; and/ or

- Investing up to $12,500 in a Funeral Bond.

How Can Morrows Help?

We highly recommend you seek advice from your Morrows Private Wealth Advisor prior to making any decisions regarding your finances. Should you wish to make an appointment please contact Morrows on 03 9690 5700 today.