The new SMSF Audit requirements (APES 110) – are they the road to perdition?

The new independent standards commence on 1 July 2021. All “in-house audits” (not independence qualified) after this date will require an independent auditor to sign off on the audit. Where funds are in progress or haven’t been started at 30 June 2021, the audit must be completed by the NEW INDEPENDENT AUDITOR. How are you going to manage this process with clients that are slow to provide data or query answers?

Some deadly traps to think about:

- How are you going to audit under the “independence” regulations that require you to outsource your auditing of SMSF’s where your firm undertakes both auditing and compliance or provides financial planning advice ?

- Do you realise direct swaps with another firm and pooling by several firms will be closely scrutinised by the ATO?

- How are you going to communicate the change in auditor tactfully to the Trustees, who may not want additional scrutiny by unknown accountants?

- How are you going to recover the time spent transferring all required documentation to the new auditor – signed Deeds, LRBA documentation, lease agreements, etc.?

- How will your clients feel about paying for extra time required by the new auditor to understand their complex funds?

- Who will negotiate the new auditor’s fees?

- How will you synchronise outstanding work in progress to manage your job completion? Particularly if this work includes unit trusts, then the fund will no longer be under your firm’s control.

- How will you handle delays in receiving a signed audit certificate which impacts both cash flow and clients’ expectations?

- How will you meet lodgement deadlines, Centrelink requirements and file early lodgements to secure big refunds for pension clients? Given that they will no longer be under your control, you will be beholden to the auditor.

Morrows is proud to have long been recognised as experts in SMSF audit by our peers. We are fortunate to be supported by the technical resources of Morrows Legal for any difficult cases.

Call Maureen Allan (03 9690 5700) or email mallan@morrows.com.au to discuss how we can help you with any of the above queries.

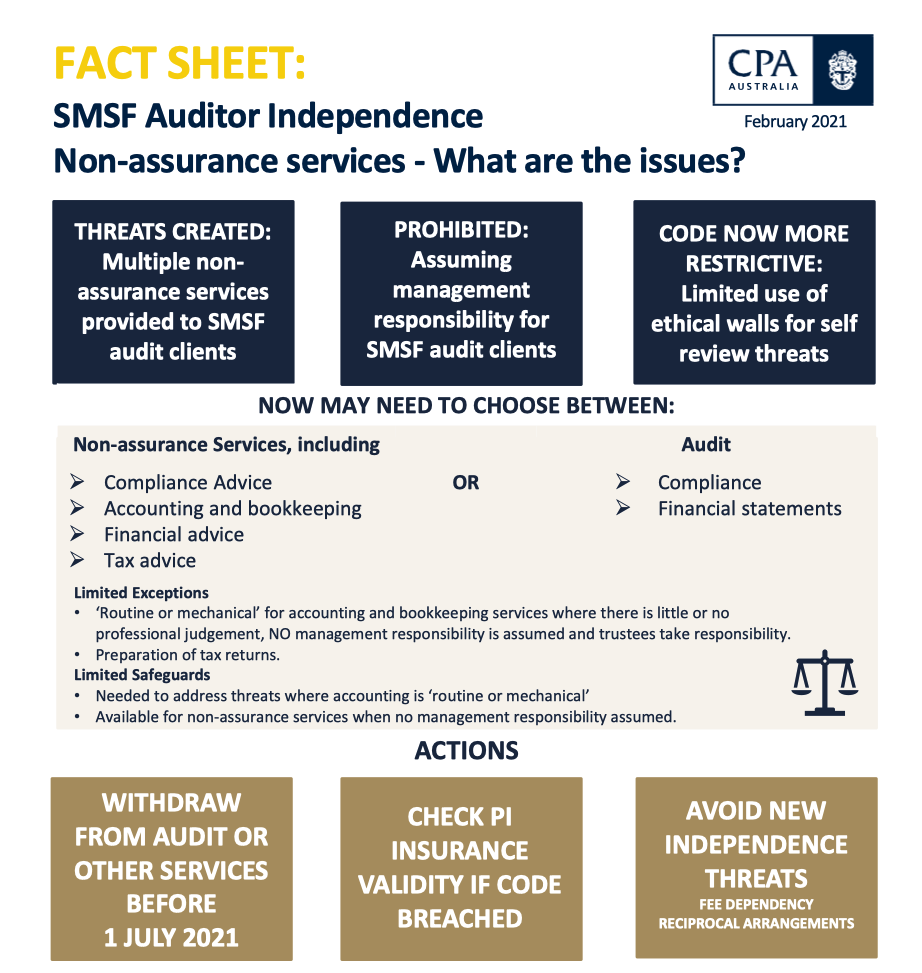

For more information please see refer to CPA Australia’s FAQ’s document and extended fact sheet on the issue.