The investment landscape is changing…Are investors changing with it?

The supply of and demand for private capital (in both equity and debt markets) and alternative investments has increased dramatically since the early 2000s. Global institutional investors (e.g. US Pension funds) have doubled their allocation to alternative assets and private markets, from less than 10% in 2001 to over 20% in 2021, while the average individual investor has roughly 5% of their investable assets allocated to alternatives.

So why should non-institutional investors invest in private markets and alternative assets?

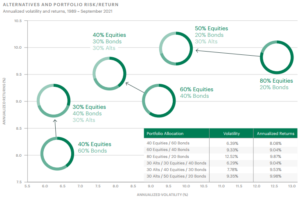

The chart below shows a J.P. Morgan analysis that incrementally adds these assets to a portfolio and how it can enhance the portfolio outcomes. This analysis shows, a portfolio with an allocation of 60% public equities and 40% public bonds had annualized returns of 9.04% with annualised volatility at 9.33%.

By adding 30% of alternative assets (and reducing equities by 20% and bonds by 10%) the return outcome improves to 9.53%, and the risk (as measured by the volatility of returns) reduces to 7.78%. This analysis highlights the ability of these assets to improve the absolute outcome and also the relative or risk-adjusted result.

What does that mean for investors?

Investment opportunities that were once the exclusive domain of institutions and banks are now becoming more available to individual investors on a widespread basis.

How can Morrows Private Wealth help?

If you would like to learn more about alternative and private markets assets, Morrows Strategic Advisory team can help you understand and assess whether these investment strategies are suited to your individual needs. Please reach out to our team to learn more.