In life, we often plan for the expected—holidays, milestones, buying a home, and retirement. However, it’s just as important to plan for the unexpected. While we can’t predict the future, we can take steps to ensure that our loved ones are equipped to handle whatever comes their way.

Creating an Estate and Financial Emergency Plan is one of the most effective ways to do this. This plan includes all the essential financial, legal, and personal information your family will need in an emergency, giving you peace of mind.

What is an Estate and Financial Emergency Plan and What Should It Include?

This plan is a comprehensive document that organises the critical information your family will need in an emergency. It goes beyond contact details to offer clear instructions on handling your financial and legal affairs. This ensures your wishes are understood, and your loved ones can manage your affairs without unnecessary stress.

Key components of the plan could include:

- Trusts and Corporate Structures: An overview of your assets, business entities, and how they are managed.

- Emergency Contacts: People who should be contacted in an emergency or death, such as loved ones and business associates.

- Assets: Provide a detailed account of your financial assets, real estate, and investments, along with contact details for banks or property managers.

- Estate Plan Instructions: Guidance on managing your estate, including wills, powers of attorney, healthcare directives, and preferences for organ donation and funeral arrangements.

- Trusted Advisors: Contact details for your financial advisors, attorneys, and accountants.

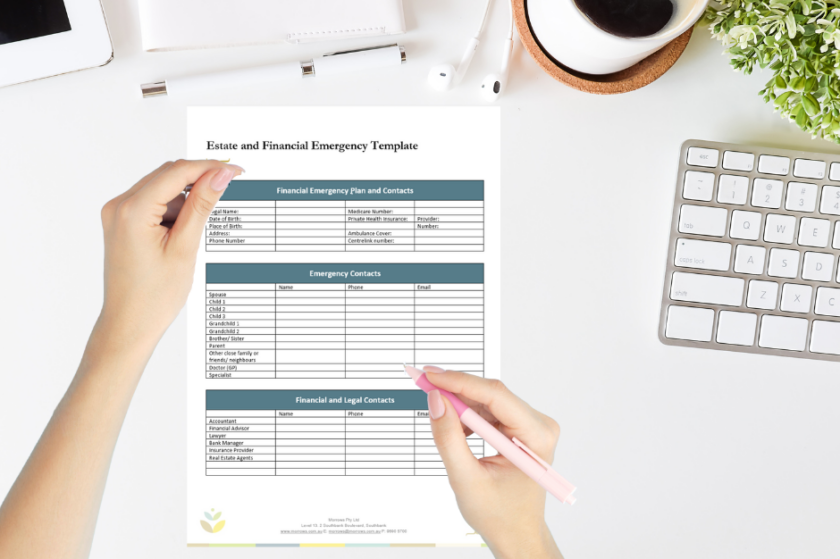

Our Morrows Estate and Financial Emergency Plan includes a template covering key details and tips to help you prepare your loved ones for the unexpected.

Don’t Stop There: Ensure Access to Critical Information

Creating a plan is vital, but it doesn’t stop there. For your family to manage your affairs smoothly, they need access to your digital assets, passwords, and important documents.

Our template includes actionable steps to help you organise and secure this information. From setting up password managers to storing vital documents, and a detailed checklist that ensures your loved ones can access everything they need when it matters most.

Morrows Estate and Financial Emergency Plan Template

We’ve developed a comprehensive template at Morrows to help you get started. This template includes all the information you need, and your Morrows advisor can assist in prepopulating the template with any financial or legal details we have on file.

Next Steps

Complete the form below to download your copy of the Estate and Financial Emergency Guide and Template, then follow these steps:

- Template Population: You can start populating the template yourself; otherwise, your Morrows advisor can help prepopulate it with any information we already have, saving you time. Please let your advisor know if you need help.

- Distribution: Once complete, share copies of your plan with trusted individuals, such as your spouse, children, or executor, ensuring they have access when needed.

- Passwords and Document Access: Ensure your family can access passwords, digital accounts, and key documents. The template outlines how to organise these details.

- Annual Reviews: Review and update your plan annually or after significant life changes to keep it current.

By taking these steps, you’ll provide your family with the support and security they need to manage any emergency confidently.

How Morrows Can Help – Download Our FREE Template today!

To download the Estate and Financial Emergency Plan template, please complete the form below.

If you need more help populating the document, reach out to your Morrows advisor, they are more than happy to help you and your family.