While DIY Will kits appear to be a great way to save time, money and hassle they are now causing serious concerns as many Lawyers are experiencing a rise in cases requiring significant advice to unravel issues.

DIY wills are often ambiguous, or misinterpreted, or they are not valid and are therefore open to be challenged.

Most people are also unaware that the legal fees of both sides of an estate challenge are payable by the estate.

Wills are rarely simple these days and the biggest danger of a DIY Will is you can make errors which can end up costing an Estate tens of thousands of dollars.

Common pitfalls of a DIY Will

- Not keeping your will up to date when your financial circumstances or family dynamics change.

- Forgetting to mention overseas assets.

- Cutting family members out who have a strong legal claim.

- Not witnessing the will correctly.

- Appointing a friend as an executor who may not have the financial competence required to administer the estate. Or alternatively appointing someone with a conflict of interest such as a business partner or family member.

- Not considering the impact of any debt or tax that may make inheritance between beneficiaries unfair.

- Leaving assets that you don’t actually own – such as assets held jointly, or in a family trust or company, superfund or the beneficial interest in a life insurance policy.

- There is sometimes scope for abuse with unscrupulous family members influencing wills that suit their personal ends by pressuring family members away from the eyes of an independent professional.

The key to a quality estate plan is quality advice.

Seek professional advice

Obtaining professional legal advice from an estate planning specialist is the best way to make sure you have a legally binding will that ensures your wishes are accurately documented and executed. This is especially important in today’s more complex world of blended families, family trusts, extensive personal chattels, superannuation, life policies and overseas assets.

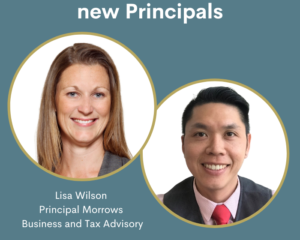

Morrows’ Legal service provides professional advice to protect your wealth and your family’s future and while a will is the building block of any good estate plan there are many other things to consider. We would be happy to assist you further to give you peace of mind that on your passing, your assets are transferred tax efficiently in accordance with your wishes and intentions.

It is also worth noting that with our ageing population it is important that older people understand they may need to use their assets to finance their old age care and put that need ahead of meeting their children’s expectations of receiving an inheritance. For more information see our article on Aged Care which outlines “Morrows Golden Rules for your Golden Years” click here.