Morrows Private Wealth investment committee members, Chris Molloy (CIO), Laurel Moulynox (General Manager) and Murray Wyatt (Chairperson) recently attended a portfolio construction conference in Sydney. The conference featured 35 leading international and local portfolio construction experts offering their insights into the key factors underpinning the Australian economy, how they are shifting and what lies ahead for investment markets.

Remarkably long economic expansion

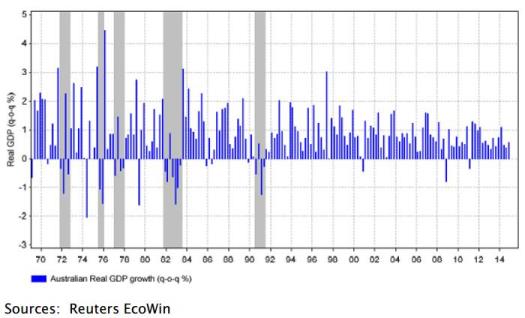

Australia has not had two consecutive quarters of negative growth since the 1990’s. It begs the question – how did Australia manage to achieve such a long phase of growth and is it sustainable or not? The ‘special’ factors underpinning the economy include a run-up in household indebtedness, strong rise in housing prices, commodity super cycle and an associated China industrial revolution. The conference highlighted the US interest rate normalisation and Chinese economic growth as key influences on the sustainability of the ‘special’ factors.

US interest rate normalisation

The US Federal Reserve (Fed) is reluctantly ending a long period of abnormally low rates. It has been nine years since central banks intervened in financial markets, quashing volatility and inflating risk asset prices. Speculation over the first interest rate increase has been met with trepidation from markets lulled into complacency by years of cheap money and quantitative easing.

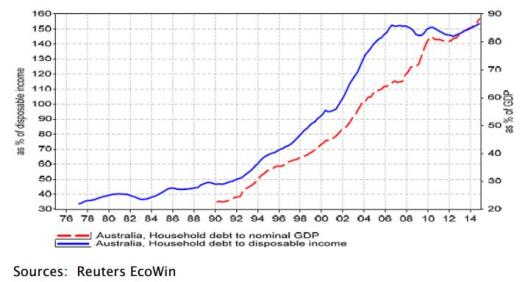

As the Fed embarks on normalising interest rates, fundamentals will take centre stage and upward pressure will come to bear on overseas funding costs for Australian banks. Australian household indebtedness grew from around 50% of disposable income in the early 1990’s up to 150% by the GFC and Australian banks are meaningfully dependent on overseas funding. Thus an increase in the marginal funding costs for banks will apply pressure to those with household debt and to the marginal buyer supporting the demand for Australian housing.

Hard landing for China

A credit fuelled property bubble enabled China to maintain its incredible run of growth through the GFC. During this property boom, over 3-4 years excess supply was constructed, similar to the recent property boom in the US. Most of China’s excess property supply is vacant, held by private investors and the remainder on the books of developers, many of whom are highly indebted. Real estate accounts for more than half of household wealth in China and if property prices fell significantly, household consumption will be materially affected.

To eliminate the excess supply, it is possible that China’s residential property construction activity could fall by as much as 50% which, again, is similar to the US during its housing crash. A large contraction in China’s property sector would cause a major slowdown in their domestic economy and consequently global economic growth.

China is a key driver of global growth, and its importance to the global economy is only increasing with time.

- China is by far the largest consumer of commodities, accounting for half of the world’s consumption of iron ore, cement, coal and steel.

- Major trading linkages with Europe, Japan and many emerging markets in Asia.

It is clear China’s industrial revolution is slowing and with it their thirst for commodities. If Chinese authorities cannot manage the perceived asset bubbles and avoid a hard landing, China will experience a sharp slowdown in economic growth and commodity exporters such as Australia will be extremely vulnerable.

What does this mean for Australia?

Since central banks commenced “cheap money” stimulus, investors have been willing to pay a high price for a high yield in Australian shares relative to global markets and demonstrated a high level of complacency.

Australia is highly leveraged to the sustainability of the economic growth outlook for China and to a lesser extent emerging markets. A significant slowdown would place downward pressure on the much intertwined Australian economy in terms of the share and property market and the level of unemployment.

Investors may wish to consider how exposed they are to “Australia” and rethink their portfolios to ensure an appropriate level of real diversification.

How can Morrows Private Wealth help?

Investors are faced with negative or very low interest rates globally, and have two main options to generate a desired level of return:

- Take more market direction risk; or

- Take more active management risk

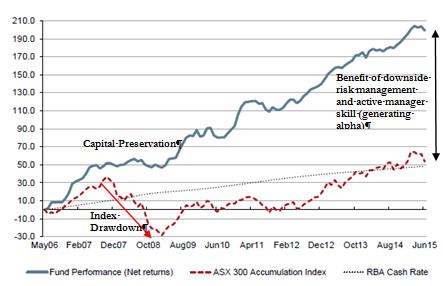

Morrows Private Wealth structure client portfolios using an unconstrained approach and have exposure to investment strategies that can participate in market upside, whilst providing some downside risk protection when markets are stressed, and generally display a better risk adjusted return profile compared to traditional ‘long only’ benchmark aware strategies over the full investment cycle.

This chart shows the performance and expected outcomes from one of the underlying managers in our recommended investment portfolio.

This Fund uses an absolute return strategy that can increase cash when risk is high, be fully invested when valuations are attractive, and hold a market neutral portfolio to generate strong risk adjusted returns.

Given current valuations we believe that it is paramount to have this type of flexibility and active management within your investment portfolio.

Our downside risk protection strategies worked very well in recent months when most asset classes experienced negative returns, and we continue to recommend holding these strategies given the uncertain outlook.

According to Chris Molloy MPW (CIO ) “Investors who think they are diversified could be in for a shock when markets become stressed”. At Morrows we focus on “true” diversification to ensure a better investment experience for our clients.

We welcome the opportunity to discuss and review your situation and determine if there are areas we can assist and provide advice in. Please do not hesitate to contact Morrows Private Wealth on:

Telephone: (03) 9690 5700 or Email: mpw@morrows.com.au

Disclaimer: The information provided in this communication is general in nature and not intended to be advice. You should contact our office for further information or for a tailored solution to your needs.