Is your business ready for the biggest change to business processes, processing payroll and reporting to the ATO since GST was introduced?

As of 1 July 2019 all employing businesses will now be required to commence Single Touch Payroll Reporting (STPR). STPR is a government initiative that changes how Australian businesses report payroll information to the ATO. It became mandatory for employers with 20 or more employees from 1 July 2018 and will be compulsory for all remaining employers from 1 July 2019.

What is STPR ?

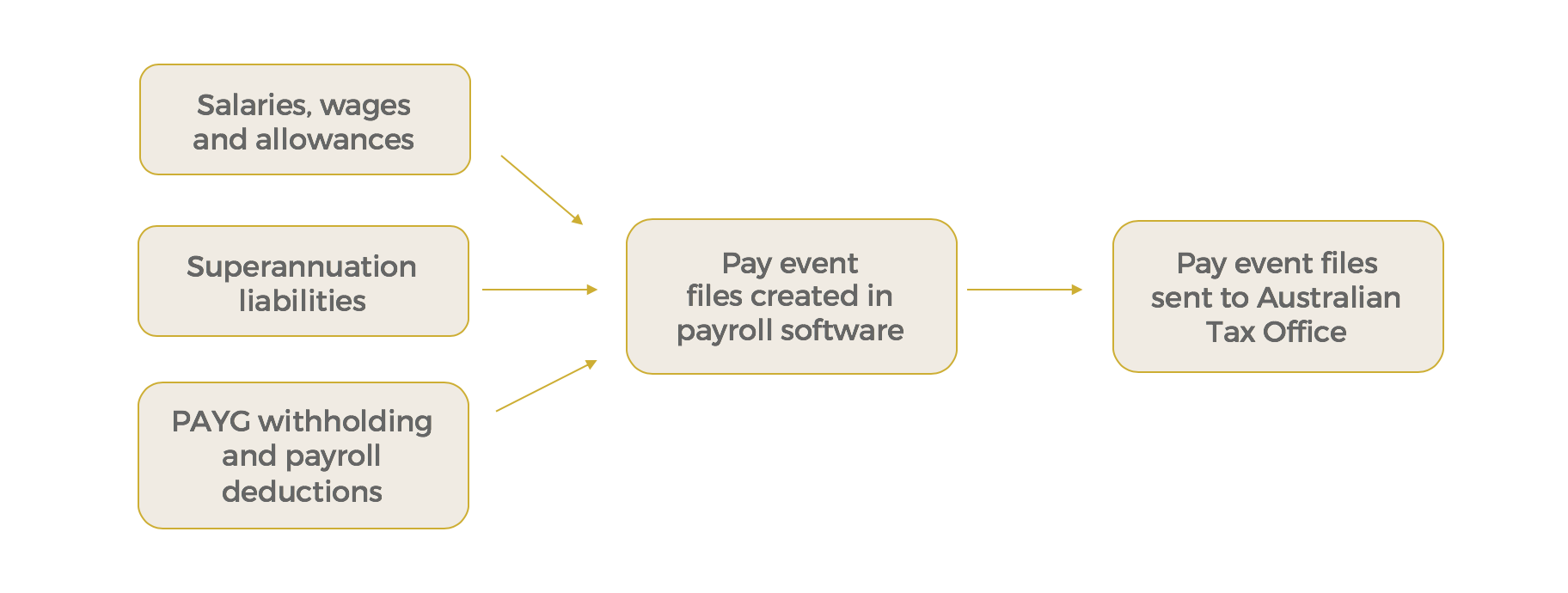

Single Touch Payroll Reporting means all employers will have to report gross payments, allowances, PAYG withholding and superannuation to the ATO each time they process a payroll during the year.

Why has STPR been introduced?

The government has introduced these changes as a way of making real-time data available to employees and to the ATO, streamlining the reporting process, reducing the need for year-end payment summaries and ensuring superannuation payments are reliably made. In the future this data will also assist with prefilling BAS information.

Benefits of STPR to small business

STPR has undergone a rigorous consultation process over the course of the last three years in order to ensure it aligns with the natural business systems of an employer. The primary aim is to work with businesses in order to prevent additional compliance requirements. The benefits of STPR are anticipated to be far reaching and include:

- Helping employers streamline their reporting process to the ATO

- Being used to pre-populate the wage and PAYG sections of the BAS which will eliminate potential errors and

double handling - Eliminating the need for payment summary processing and end of year reporting obligations

- Providing employees real-time access to payroll data via their MyGov account

- Allowing the ATO to proactively monitor payments of PAYG and superannuation guarantees earlier to notify

employees of non-compliance – complying employers will feel like they are now operating on a level playing

field.

What do you need to do?

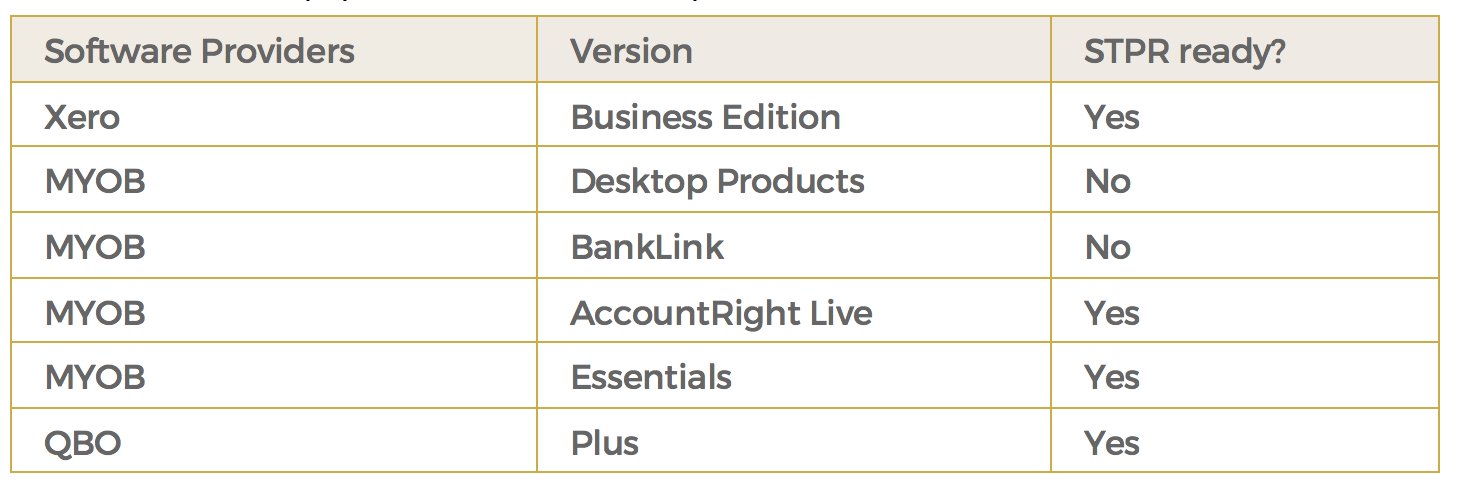

All employers will need to ensure their payroll software is compatible with STPR reporting. The following table sets out which payroll software is STP compliant:

If your software isn’t STPR compatible there are a variety of payroll reporting solutions available to assist with your reporting requirements. For example, Xero will offer a $10/month payroll solution for businesses with 1-4 employees.

Depending on your software, STPR can take only a matter of minutes to setup. Once you have STPR compliant software you will need to ensure that all employee details are entered correctly including tax file number and address. Your payroll officer (which could be you) will need to be listed as an authorised contact so they can liaise with the ATO regarding any STPR queries.

How does STPR work?

Each time you prepare a pay run an electronic “pay event” file will be created which will be submitted to the ATO after an electronic declaration has been signed. By completing this process, it will remove the need for annual payroll reporting as the ATO will already have this data.

The ATO has introduced STPR to increase transparency around wage and superannuation payments that employers make to and on behalf of their employees. Once setup, STPR reporting will seamlessly integrate with your current payroll processes and will ensure minimal impact on your business whilst maintaining compliance with these new ATO requirements.

What if you make a mistake?

There are ways to correct a pay run with an error depending on if the pay run has been posted and information sent to the ATO, or if you simply need to delete and re-do your pay run. The options will depend on the software you use.

How can Morrows help?

- Be proactive: Be proactive in preparing for STPR by ensuring your software is up to date and compliant

- Go digital: If you require digital payroll software, consider solutions that will not only be STPR compliant

but will provide other tools such as employee self-service, time and attendance functionality that allows for

award interpretation that can be built into the software. - Find an expert partner: Outsourcing your payroll function can also be a practical option. Payroll professionals will ensure your payroll is compliant, can setup any required payroll solutions and resolve any relevant queries.

If you have any questions relating to STPR or outsourcing your payroll, please contact the Morrows Business Technology team for more information by calling 03 9690 5700 or set up a meeting with one of our advisors to discuss your needs.