SMSF trustees have until 31 January 2017 to get their related party/non-bank LRBA’s compliant with the ‘safe harbour’ guidelines.

In order to avoid triggering the NALI (non- arm’s length income) provisions, the terms of a related party/ non-bank loan must comply with the ATO’s Practical Compliance Guidelines (PCG 2016/5).

PCG 2016/5 sets out the safe harbour terms for new and existing complying LRBA’s which, if adopted, will mean the LRBA is taken to be consistent with an arm’s length dealing.

Under the guidelines there are three methods for meeting these requirements:

- Ensure your terms and conditions of the loan align with the safe harbour guidelines: OR

- Re-finance the loan with a commercial financier.

- The LRBA is brought to an end.

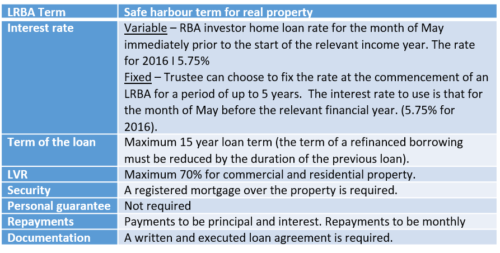

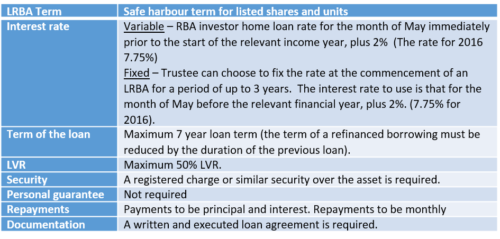

The ‘safe harbour’ guidelines do have different terms depending on the nature of the asset being acquired under the LRBA .

LRBA safe harbour terms for Real Property:

LRBA safe harbour terms for listed shares and listed units:

The ATO at paragraph 4 of PCG 2016/5, confirms that compliance is not mandatory. If the trustee(s) of an SMSF decide not to comply with these guidelines it does not mean that the LRBA will be subject to the NALI provisions. However, to demonstrate your arrangement is commercial and consequently the income from the LRBA not treated as NALI, you will have to provide documentary evidence that related party loan’s terms and conditions are the same as those available from a commercial financier.

Where Morrows audits the superannuation funds that have a related party LRBA in place, we will require confirmation from an independent mortgage broker, that the loan is commercial and the superannuation fund would have been able to obtain a similar loan with the same conditions.

Where a member has obtained a personal bank loan and lends that money to the superannuation fund under a LRBA , the auditor will require documentation from the bank that the loan would have been approved if the borrower was the superannuation fund and not the individual.

How can Morrows assist to ensure that your LRBA is within the Safe Harbour guidelines:

- Register Mortgage – cost estimate of approx. $1,000.

- Lodgement and associated fees – cost estimate of approx. $150

- Amend Loan agreement to bring within the Safe harbour as follows;

- Security under the loan

- Duration of loan

- Interest rate

- LVR

- Monthly repayments of principal and interest.

(A quote will be given for amended loan agreements).

Please contact Maureen Allan from our office for further information.