Summary of the changes effective from 1 July 2016.

The ATO has released Practical Compliance Guidelines PCG 2016/5 detailing interest rates, LVR ratios and other terms that constitute “Safe Harbours” for SMSF limited recourse borrowing arrangements (LRBAs) so that arrangements will be taken to be consistent with an arm’s-length dealing.

Where related loans are not within the ‘Safe Harbour” guidelines the income derived from the mortgaged asset will be classed as non arm’s-length income (NALI) and taxed at top marginal rates.

The ATO’s Guideline is critical for SMSF trustees that have already entered into LRBA and trustees that are considering entering into LRBA, that are non-bank financed.

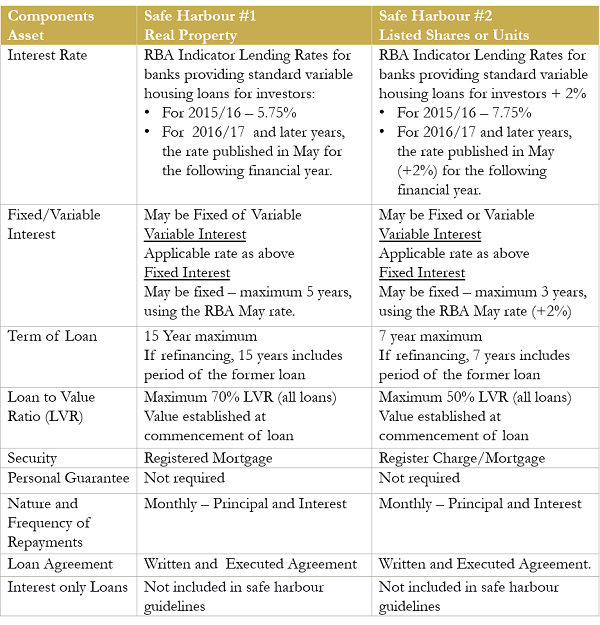

The ATO provided two examples of the various components of a related party LRBA within the Safe Harbours in the PCG, which are summarised in the table below:

While these terms make up the safe harbour for arm’s-length arrangements for LRBAs, the ATO does acknowledge in PCG 2016/5 that other arrangements can still be regarded as arm’s-length. However, the trustee will need to be able to prove that the arrangement has been entered into and maintained on an arm’s-length basis. The ATO provides the example of a trustee being able to prove that the related party loan which forms part of their LRBA is made on an arm’s-length basis because it replicated the terms of a commercial loan that is available in the same circumstances.

Action Points before the 30 June 2016 deadline – that’s in approximately 2 months.

It is important to note PCG 2016/5 applies for all of the 2016 year.

- Review all related party loans to ensure they comply with the PCG 2016/5 guidelines.

- Where they do not meet the guidelines, altering the terms of the loan so they are consistent with the safe harbour terms, even if that might require retrospective adjustment for the current financial year.

- Paying necessary interest and loan repayment to ensure that payments for the 2015-16 income year meet arm’s-length requirements.

- Reducing LVRs and making sure that the adequate principal and interest payments have been made for the 2015-16 income year.

- This may require making additional funds via contributions, rollovers or selling assets to reduce the loan balance.

All these strategies would need to be undertaken and completed by 30 June 2016, making immediate action necessary if trustees are to comply with the condition spelled out in PCG 2016/5.

The ATO has not provided any Safe Harbour guidelines in respect of Unit Trusts, such as unlisted (widely held) trusts and more particularly Reg.13.22C trusts. The onus is on the SMSF trustee to obtain sufficient and appropriate evidence to support the arm’s-length nature of the terms of their LRBA. This may be difficult where there is no readily available market information and quotes and proposals from third parties and other sources may need to be researched and documented.

With the 30 June 2016 deadline, imminent action will be required to ensure related party loans comply with the safe harbour terms or face paying the top marginal tax rate on the mortgaged assets income. Exemptions for pension income will not apply.

Morrows are experts in remedial strategies to comply with PCG 2016/5 guidelines.

Contact Murray Wyatt on 96905700 for assistance.