Morrows Private Wealth identify sequencing risk as a significant threat to the security of our clients meeting their retirement lifestyle goals and have developed an investment approach to effectively mitigate this risk.

Sequencing Risk

Sequencing risk is the risk that the order and timing of investment returns is unfavourable.

Investment returns, good and bad, have more impact at some points of your lifecycle than at others.

Negative investment returns leading into or early in retirement can be particularly damaging to your ability to achieve your desired retirement lifestyle.

S&P/ASX300 Price Index Drawdown (1980-2013)

Source: Morningstar

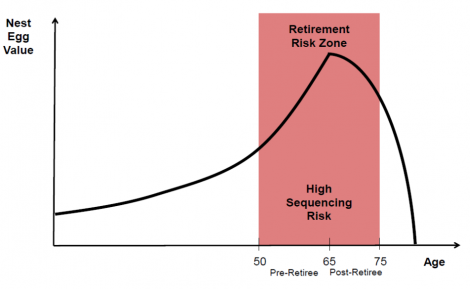

Sequencing Risk Peaks at Retirement

Sequencing risk increases when you approach retirement as there is more capital at risk and less time to recover capital losses.

If you experience a significant investment loss when your nest egg is nearing its greatest position it will have a greater impact on how long your savings will last.

Therefore sequencing risk affects you both pre-retirement as well as post-retirement in drawdown phase as highlighted in the chart below.

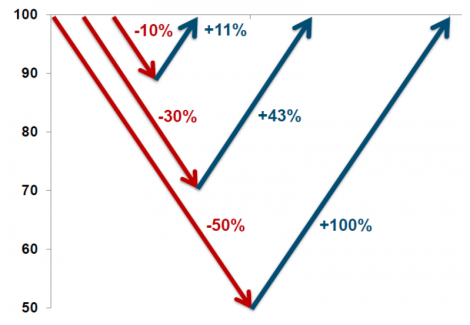

Don’t let Sequencing Risk Spoil your Retirement

Market crashes or corrections occurring in the retirement risk zone, will lead to more detrimental implications on your capital. This is due to the fact that it will require a greater investment return to fully recover the losses.

For example, if you lose 10% of your capital it requires an 11% return to restore the capital to its original amount. But if you were unfortunate to lose 50% of your capital it requires an extraordinary effort to deliver 100% return in the following period to restore the capital.

Harder to make back Money Lost

The recovery of original capital is further inhibited if you are retired and withdrawing a pension from your capital to live which is common for most retirees.

Why Morrows Private Wealth?

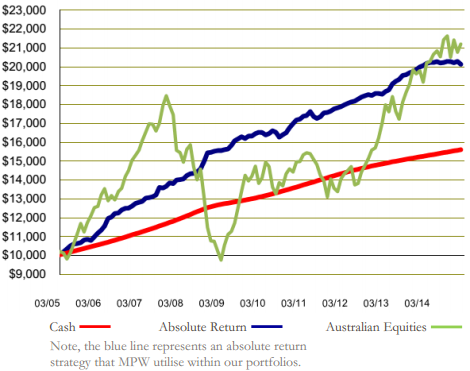

We focus on achieving positive absolute returns regardless of whether markets are rising or falling as opposed to following market “rollercoaster” volatility (green line).

The blue line in the chart below shows that focusing on positive absolute returns can smooth investment returns over the cycle, preserving capital against large drawdowns and as a consequence mitigating sequencing risk.

Our portfolios performed exceptionally well, protecting client investment capital in the September 2015 quarter when most asset classes experienced negative returns and traditional asset class diversification failed.

Written by Kyle Brumley, Senior Paraplanner, Morrows Private Wealth

Contact Us

We welcome the opportunity to discuss and review your situation and determine if there are areas we can assist and provide advice in. Please do not hesitate to contact:

Chris Molloy, Chief Investment Officer or

David Alcorn, Principal, Morrows Private Wealth

Ph: 03 9690 5700 or email mpw@morrows.com.au