The leak of the “Panama Papers” has been one of the biggest scandals to hit the headlines in recent times. It’s being called the “Wikileaks of the mega-rich”, but what exactly is the scandal all about?

A brief overview

Papers leaked from one of the world’s largest offshore law firms, Panama-based Mossack Fonseca, refer to more than 214,000 trusts and companies in over 200 countries that are being used for tax avoidance.

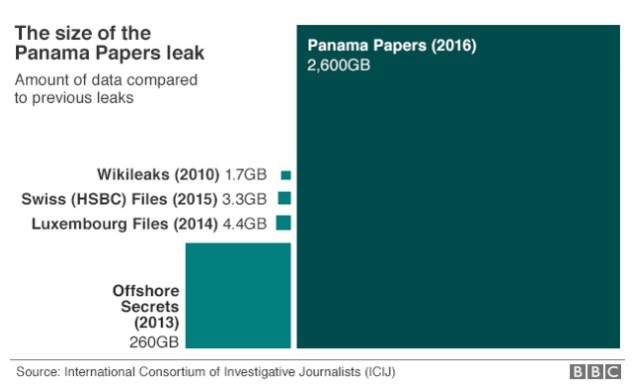

The controversy started with a whistleblower who leaked a huge number of documents and data online. At 2.6 terabytes of information, this leak dwarfs the leaks by Wikileaks of documents relating to the Iraq war and Edward Snowden’s leaks of NSA surveillance details. Once again, it demonstrates how all organisations are now vulnerable to vast caches of information being smuggled out on a computer hard drive or USB stick.

Messi. Putin. Cameron. It seemed that the Panama Papers were connected with a staggering number of high-profile names. The 1.5 million leaked documents identify these high profile presidents, prime ministers, sports stars and business people in connection to the secret offshore companies. The leak has now claimed its first casualty after Iceland’s Prime Minister Sigmundur David Gunnlaugsson resigned following allegations he had sought to hide his wealth and dodge taxes.

The scandal is really about non-disclosure

Using offshore structures is entirely legal. There are many legitimate reasons for doing so. Business people in countries such as Russia and Ukraine typically put their assets offshore to defend them from “raids” by criminals, and to get around hard currency restrictions. Others use offshore entities for reasons of inheritance and estate planning.

However, most of what has been going on is about hiding the true owners of money, the origin of the money and avoiding paying tax on the money – in particular where there is non-disclosure of information. Setting up an offshore entity is not illegal in Australia, however failing to disclose certain information to the tax office may be an offence.

Some of the main allegations centre on the creation of shell companies, that have the outward appearance of being legitimate businesses, but are just empty shells. They do nothing but manage money, while hiding who owns it.

How is Australia involved?

The ATO is currently investigating more than 800 wealthy people for possible tax evasion linked to their alleged dealings with Mossack Fonseca, with more than 120 of them linked to an associate offshore service provider located in Hong Kong. The leak included personal emails from Australian clients to the law firm, asking how to “reduce or zero my tax” and requesting “complete privacy and secrecy”. There are also extensive references to Australian banks in the documents.

What will be the fallout?

The fallout from the leak is only just beginning. The biggest consequence is the massive blow to secrecy – the biggest selling point of offshore tax havens.

More documents and possibly more big names will be revealed in the weeks to come. What that means for global financial and tax transparency is not certain but one thing is for sure – the fallout from the leak of the “Panama Papers” is bound to felt for many years to come.